We’ve summarised the key changes in the UK Autumn Budget 2024.

From tax adjustments and business support to cost-of-living assistance and investment planning, this budget introduces significant updates impacting both personal and business finances.

In this blog post, we’ll help you understand how these changes may influence your financial strategy moving forward.

UK AUTUMN BUDGET 2024 HIGHLIGHTS

- £40bn Tax Increase: National Insurance for employers raised to 15%, income threshold lowered.

- Capital Gains Tax Increase: Lower rate to 18%, higher rate to 24%.

- Fuel Duty Freeze: Continues freeze, supporting households and businesses.

- VAT on Private School Fees: Effective from January 2025.

- NHS Funding Boost: £22.6bn increase aimed at reducing waiting lists.

- Housing Investment: Over £5bn for affordable housing and urban development.

- Minimum Wage Increase: 6.7% rise, supporting workers from April 2024.

- Carbon Capture & Green Hydrogen: 11 new projects advancing clean energy.

Introduction: Laying the Foundations for Change

The Autumn Budget 2024 arrives during a time of transformation following the 4th July general election, with the Labour government pledging a path of economic renewal. Chancellor Rachel Reeves has outlined a plan aimed at rebuilding public services, strengthening the NHS, and providing relief for households facing cost-of-living pressures.

This Budget introduces significant measures, including a £40bn tax increase, adjustments in Capital Gains Tax, and additional funding for healthcare, education, and infrastructure. It also includes a freeze on fuel duty, a rise in the National Minimum Wage, and reforms to employer National Insurance contributions. For businesses, especially SMEs, these changes reflect a focus on fostering a stable and supportive business environment.

Our guide provides an in-depth look at these updates, helping Demsa’s clients understand how these changes may impact their personal and business finances. With this resource, we aim to offer clear insights to support informed financial decisions in response to the evolving economic landscape.

Economic Growth and Stability

Chancellor Rachel Reeves stressed that economic growth depends on long-term investment.

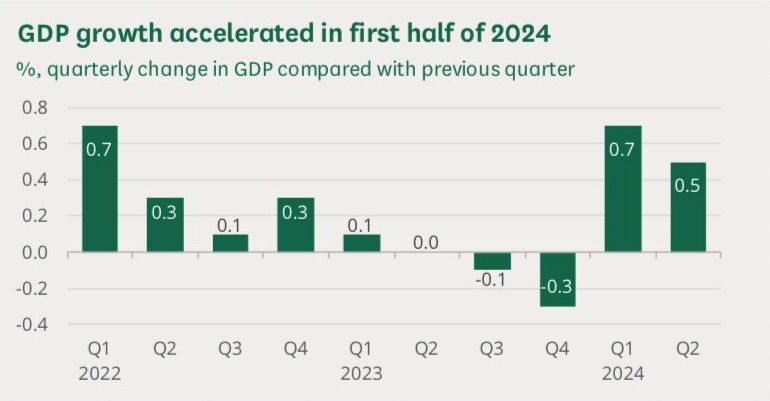

In the first half of 2024, the UK economy showed strong recovery, with a GDP growth of 0.7% in Q1 and 0.5% in Q2. This rebound was largely driven by the services sector, underscoring the importance of economic stability and strategic investment.

Source: ONS, quarter-on-quarter GDP growth, series IHYQ

Tax and Revenue Adjustments

The Budget introduces major tax adjustments aimed at fiscal stability and fairness:

£40bn Tax Increase: Employer National Insurance contributions will increase to 15%, while the income threshold for businesses drops from £9,100 to £5,000. This will impact businesses of all sizes, especially SMEs, and may require careful budgeting adjustments.

Capital Gains Tax: Rates will increase, with the lower rate moving to 18% and the higher rate to 24%, affecting those with substantial investments or secondary properties.

Fuel Duty Freeze: Fuel duty will remain frozen, continuing the current relief for households and businesses.

VAT on Private School Fees: From January 2025, private school fees will incur VAT, reflecting the government’s aim for a more balanced tax system.

These adjustments are intended to stabilise the economy while avoiding extensions to the freeze on income tax and National Insurance thresholds beyond 2028, safeguarding working individuals from additional financial burdens.

Public Spending Initiatives

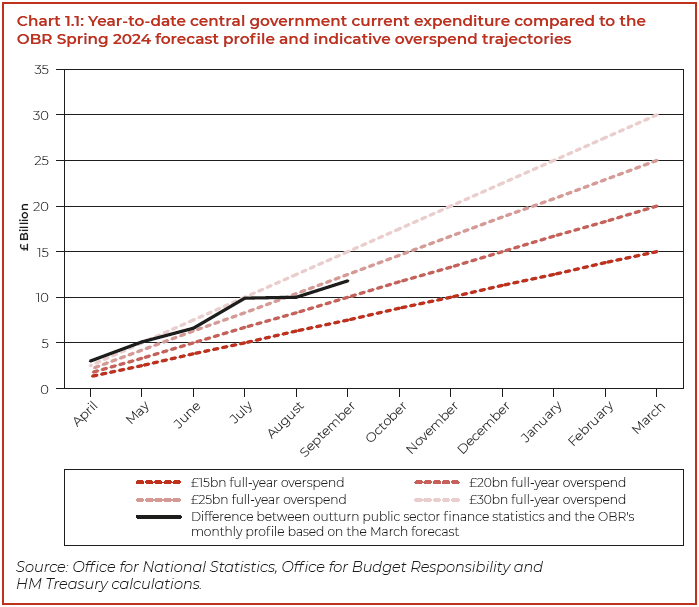

Several major public spending commitments have been outlined. The chart below illustrates the trajectory of central government spending, showing potential overspend projections based on current fiscal pressures:

- NHS Funding: A £22.6bn increase in the health budget aims to reduce NHS waiting lists and improve access to care.

- Housing Investment: Over £5bn will support affordable housing initiatives, urban development, and the construction of 2,000 new homes nationwide, providing much-needed support for housing supply.

- Infrastructure: Funding is secured to extend HS2 to London Euston, along with an additional commitment to road maintenance to address one million potholes annually, improving transport efficiency.

Cost of Living Support

To alleviate cost-of-living pressures, the Budget introduces several supportive measures:

National Minimum Wage: Effective from April, the minimum wage will increase by 6.7%, benefiting various age groups, including apprentices.

Carers’ Allowance: This will increase, enabling carers to earn over £10,000 annually while receiving financial support.

Universal Credit Debt Repayments: Household repayment rates on Universal Credit will decrease from 25% to 15%, benefiting 1.2 million low-income households by allowing them to retain more of their monthly income.

Corporate and Small Business Support

The Budget also includes several provisions for business growth and financial support:

Employment Allowance Increase: This will rise to £10,500, providing relief from National Insurance contributions for 865,000 small businesses, reducing financial strain and supporting growth.

Efficiency Savings: Government departments are expected to meet a 2% productivity savings target, overseen by the newly appointed Covid Corruption Commissioner, to promote financial efficiency across public spending.

Energy and Environmental Investments

With the UK’s commitment to green energy, the Budget introduces initiatives to strengthen the nation’s position as a clean energy leader:

Carbon Capture and Green Hydrogen Projects: Eleven new projects are planned across the UK, aimed at advancing carbon capture and hydrogen technologies.

GB Energy: The new energy institution in Aberdeen will drive clean energy initiatives, support innovation, and create employment opportunities in the sector.

Education and Social Services Investment

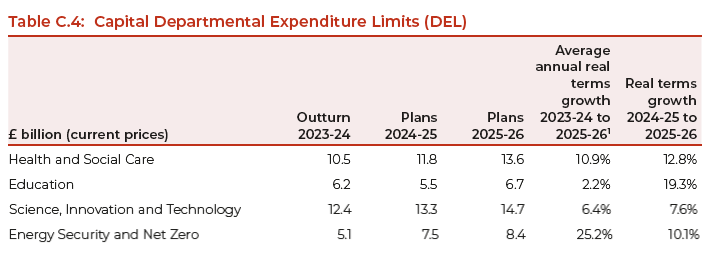

Education funding sees a significant boost, addressing immediate needs and supporting future growth. The accompanying chart highlights the planned capital departmental expenditure limits for key sectors, showcasing the government’s commitment to education, health, and sustainability:

- Health and Social Care: The health sector will see an increase in funding to support improved healthcare infrastructure, which is crucial for reducing wait times and enhancing access to services.

- Education: An additional £6.7bn will be allocated next year, including £1.4bn specifically for rebuilding schools most in need, ensuring safer and more modern learning environments.

- Science, Innovation and Technology: Investments in science and technology aim to drive innovation and support the UK’s position as a leader in technological advancements, promoting a knowledge-based economy.

- Energy Security and Net Zero: Significant funds are directed toward energy security and clean energy projects, reflecting the government’s commitment to achieving net zero and advancing sustainable energy sources.

Labour’s Critique and Conservative Response

In response, Conservative Leader Rishi Sunak criticised the Budget as a “borrowing spree” that breaks Labour’s promises.

He contended that record-level tax increases politicise the country’s finances and could leave the economy vulnerable to future risks.

Sunak’s remarks highlighted the debate over the long-term effects of these financial policies on economic stability.

What This Means for You?

This guide clarifies how the Autumn Budget changes may impact you, whether you’re a business owner, an individual taxpayer, or navigating financial planning.

For Businesses: Changes to employer contributions, employment allowances, and small business support mean businesses may need to adjust cash flow management and seek efficient workforce solutions.

For Employees and Households: The rise in minimum wage, carers’ allowance, and lowered Universal Credit repayment rates provide immediate support. However, tax adjustments could influence future financial planning.

For Investors and Property Owners: Capital Gains Tax and property tax surcharges suggest the need for strategic investment planning and careful asset management to minimise tax impact.

At Demsa, our experts are available to help you navigate these changes and make informed decisions that align with your financial goals.

Please contact us to discuss how this Budget may specifically impact your personal or business finances.